Portugal Passive

Income (D7) Visa

The Portugal Passive Income Visa – also known as a D7 Visa – provides residency status to non-EU / EEA / Swiss citizens, including retirees, remote workers, who intend to relocate to Portugal and are in receipt of a reasonable and regular passive income.

What's the benefits of the D7 visa?

Rights

The right to live, work and/or study in Portugal. Portuguese residency rights, including education and healthcare.

Travel

Visa-free travel within the Schengen Area.

Open a business

The option to work as freelance or establish a business in Portugal.

Bring your family

An applicant may include dependant children and parents through "family reunification".

N.H.R.

The option to apply for Non-Habitual Resident (NHR) tax regime status.

Permanent residency / Citizenship

Qualification for permanent residency or citizenship in Portugal after five years.

What's the requirements?

Incomes:

- 1st adult (applicant): 100% of the current minimum wage (820€/month) = 9840€/year;

- 2nd or more adult(s): 50% of the current minimum wage (410€/month) = 4920€/year;

- Children and young people under 18 and over-dependent children: 30% of the current minimum wage (246€/month) = 2952€/year.

We need to highlight that, even if you have the minimum, the request can be denied.

So we recommend showing more than the minimum.

Documents/Requirements:

- Be a non EU-citizen;

- Proof of regular income or passive income (proof of income from movable or immovable property, or from intellectual property, or financial investments);

- Criminal record, from the country that you lived after 18 years old for a period longer than a year, apostilled;

- Proof of accommodation (1-year rental contract);

- Be willing to become a fiscal resident in Portugal;

- D7 application filled form;

- Valid passport (with 06 months in advance from the date of travel);

- 2 passport-sized photographs;

- Valid travel insurance with health coverage;

- 6 months of bank statements;

- Founded Portuguese bank account;

- NIF Number (tax number for Portugal);

How can we support you?

We make the process of applying for a visa hassle-free with our on-demand services.

We help you with:

- Obtaining a fiscal number (NIF) from the Tax and Customs Authority, with fiscal representation for a period of 01 (one) year;

- Intermediation for opening a bank account in Portugal;

- Visa documents checklist;

- Accompaniment during the visa application process, including the filling in of forms and applications and the verification of documents;

- Preparation for interviews with the Immigration Authorities;

- Certified translation of documents (from English, French, Italian and/or Spanish) and certification of documents (except those in which The Hague Apostille or legalization is mandatory);

- Recognition of signatures when and if necessary (except for those documents in which The Hague Apostille or legalization is mandatory);

- Obtaining a user number for the National Health System.

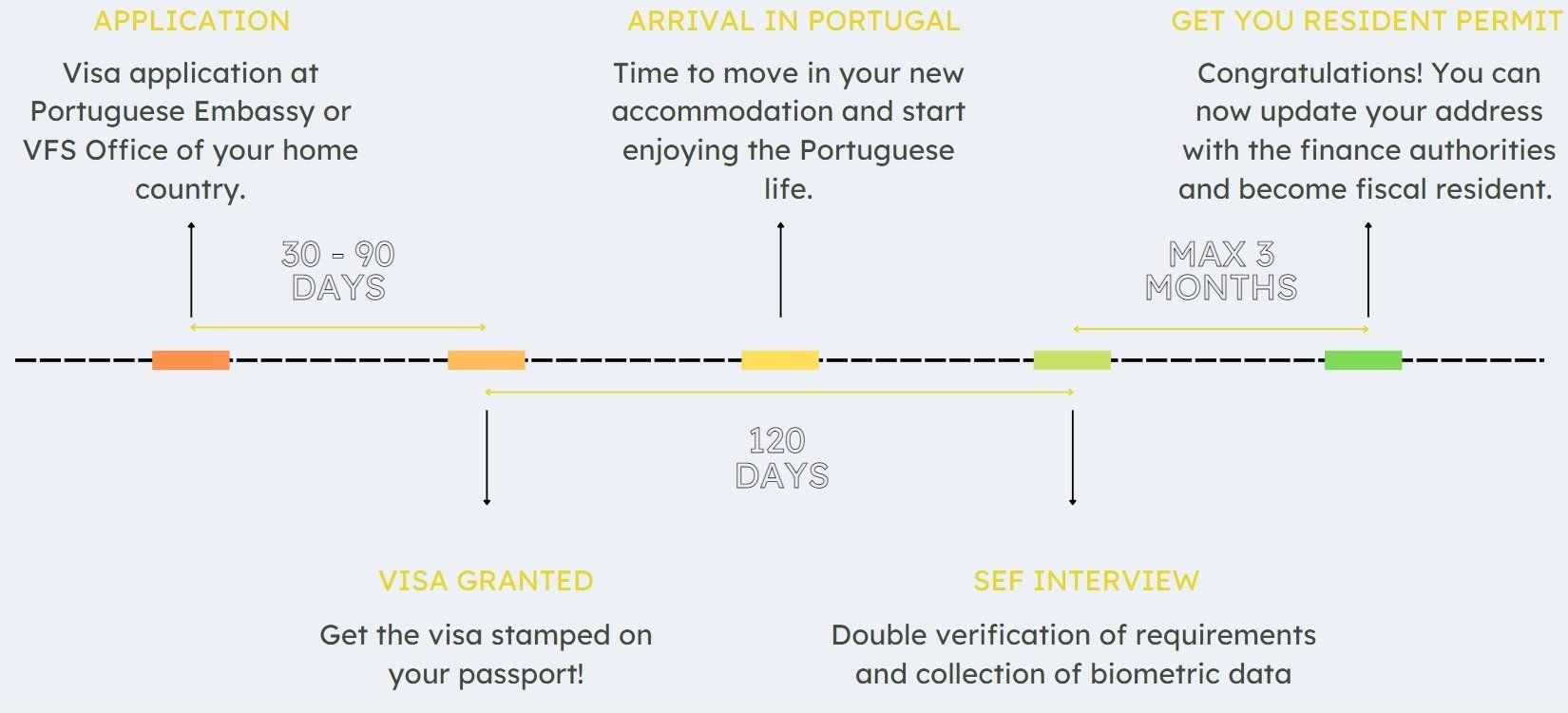

Visa application Timeline

+200

Visa granted

48

Avarage processing time

100%

Visa granted

a b c d e f g h i j k l m n o - Do not remove from template!!! it is important to support different fonts